Try Adsterra Earnings, it’s 100% Authentic to make money more and more.

Daniel Fishel

The successful dot-coms of the late ‘90s and early ‘00s had a few things in common: they all vowed to “change the world”, had crazy-high valuations, and were wildly unprofitable. Here’s a look at one company’s rapid rise and fall — and the bubble’s lasting impact, from internet historian Brian McCullough.

If you were looking for a single company that exemplified the dot-com era, you could choose Priceline.com. It was founded by Jay Walker, an entrepreneur with a clever solution to a real problem: every day, 500,000 airline seats were going unsold. Priceline offered these seats to online customers who could name the price they were willing to pay. Consumers got cheaper flights; airlines sold excess inventory; inefficiencies were ironed out of the market; and Priceline took a cut for facilitating the process: your garden-variety win-win-win-win that only the internet could make happen.

Launching in April 1998, Priceline was a dot-com “overnight success,” growing from 50 employees to more than 300 and selling more than 100,000 airline tickets in its first seven months of business. By the end of 1999, it was selling more than 1,000 tickets a day. It attempted to expand into hotel bookings, car rentals, home mortgages, and Walker’s intention was to take the Priceline idea to every applicable market.

Walker intended to get to ubiquity the way Yahoo had done: by building a brand through relentless marketing. In its first six months, the company spent more than $20 million in advertising, the keystone of which was clever ads featuring Star Trek’s William Shatner. All of this succeeded in placing Priceline fifth in internet brand awareness by the end of 1998, behind only AOL, Yahoo, Netscape and Amazon.

In March 1999, Priceline went public at $16 a share. On its first day of trading went up to $88, before settling at $69. This gave Priceline a market capitalization of $9.8 billion, the largest first-day valuation of an internet company to that date. Few investors were concerned that in its first few quarters in business Priceline racked up losses of $142.5 million. Or that it had to buy tickets on the open market — at cost — to fulfill customers’ lowball bids, losing, on average, $30 on every ticket it sold. Or that Priceline customers often ended up paying more at auction than they could have paid through a traditional travel agent. Investors were more interested in grabbing a piece of a company that was going to change the future of business.

The venture capitalists who backed companies like Priceline, eToys, and Kozmo.com were aiming for supernova IPOs because that’s when they got paid.

By 1999, losing money was the mark of a successful dot-com. And few could lose money as prolifically or creatively as Priceline. The head of a rival website named CheapTickets complained that his company couldn’t compete with Priceline’s hype. “We’ve got a policy here at CheapTickets,” founder Michael Hartley groused. “We need to make money. It hurts our valuation.”

So many of the companies that would embody what we think of when we remember the dot-com bubble — Pets.com, eToys, Kozmo.com, UrbanFetch — shared some or all of Priceline’s traits: a business plan that promised to “change the world”; a Get Big Fast strategy to reach ubiquity and corner a particular market; a tendency to sell products at a loss in order to gain that market share; a willingness to spend lavishly on branding and advertising to raise awareness; and a sky-high stock market valuation that was divorced from any sort of profitability or rationality.

It became a joke that the dot-coms that started out promising a grand vision of a more efficient way of doing business were — almost to a company — unprofitable. It’s entirely possible that a lot of them could have focused on the very real efficiencies that selling online made possible, and thereby slowly grown into sustainable businesses. But that was not the name of the game in the late nineties.

The venture capitalists who backed these companies were aiming for supernova IPOs because that’s when they got paid. Any IPO meant an exit for venture investors. Those incredible first-day “pops” that dot-com stocks experienced when IPOing? That was the early money cashing out, selling their shares to the investing public. The dot-com bubble was a fantasy period when a lot of VCs actually didn’t careif a business turned a profit, because it didn’t need to. “We’re in an environment where the company doesn’t have to be successful for us to make money,” a venture capitalist at Benchmark admitted when mulling over a pre-IPO investment in Priceline.

The bubble era engendered a fever for entrepreneurship that probably hadn’t existed in this country since before the Great Depression.

It became imperative to keep the pipeline of new companies — and new IPOs — coming. Fortunately, the bubble era engendered a fever for entrepreneurship that probably hadn’t existed in this country since before the Great Depression. By the spring 1999, one in twelve Americans surveyed said that they were in some stage of founding a business.

In October 1999, the market cap of the 199 internet stocks tracked by Morgan Stanley’s Mary Meeker was a whopping $450 billion. But the total annual sales of these companies came to only about $21 billion. And their annual profits? What profits? The collective losses totaled $6.2 billion. “People come in here all the time and say, ‘The last thing I want to be is profitable,’ ” one investment banker bragged in June of 1999. “‘Because then I wouldn’t get the valuation of an internet company.’”

Over the second half of 1999, it wasn’t a question of whether or not a bubble existed, it was a question of how big a bubble it was, and when it would pop. Most people knew it was unsustainable, but no one wanted to admit it. If you could squeeze your IPO out before the window closed, then you could pick your moment to cash out, hopefully before everyone else got the same idea.

One by one, the weakest of the dot-coms began to underperform. Dot-coms ceased being sure stock market winners — in a trickle, and then all at once. Falling stock prices turned into stock market delistings and then became actual bankruptcies. On January 14, 2000, the Dow Jones Industrial Average peaked at 11,722.98, a level it would not return to for more than six years. The tech-heavy Nasdaq peaked on March 10, 2000, at 5,048.62, a level it would not reach again until March 2015. From that March 2000 peak, all the way down to the trough it reached on October 9, 2002 (the bear market bottom would be 1,114.11), the Nasdaq would lose nearly 80 percent of its value.

By April 2000, just one month after peaking, the Nasdaq had lost 34.2 percent of its value.

Was there any one thing that pricked the bubble? No, there were a myriad of factors. The Fed had finally begun to raise interest rates: three times in 1999 and then twice more in early 2000, the most sustained round of fiscal tightening over the whole of the late 1990s. Just as suddenly, Fed language shifted to an open attempt to rein in equity prices. Added to this was the fact that Wall Street analysts began advising their clients to lighten up on internet stocks, saying the technology sector was “no longer undervalued.” But more than anything else, it was the weak constitution of all those “iffy” dot-coms that had hit the market toward the tail end of 1999 that tipped the scales, companies without a realistic chance to make money over the long term.

By April 2000, just one month after peaking, the Nasdaq had lost 34.2 percent of its value. Over the next year and a half, the number of companies that saw the value of their stock drop by 80 percent or more was in the hundreds. And for most, no recovery ever came, even for the biggest names. Priceline cratered 94 percent.

There are various ways to measure the amount of wealth that was annihilated when the bubble burst. As early as November 2000, CNNFN.com pegged the losses at $1.7 trillion. But that would count only public companies. Beyond them, it’s estimated that 7,000 to 10,000 new online enterprises were launched in the late 1990s, and by mid-2003, around 4,800 of those had either been sold or gone under. Trillions of dollars in wealth vanished almost overnight.

Between September 1999 and July 2000, insiders at dot-com companies cashed out to the tune of $43 billion, twice the rate they’d sold at during 1997 and 1998.

Obviously, that much money leaving the playing field had to have some effect on the economy. The US government would date the start of the dot-com recession as beginning in March 2001. And by the time of the economic shock from the terrorist attacks of September 11, 2001, there was no longer any doubt. In that tragic month of September, for the first time in 26 years, not a single IPO came to market. The dot-com era was over.

Of course, the era didn’t end disastrously for everyone. Between September 1999 and July 2000, insiders at dot-com companies cashed out to the tune of $43 billion, twice the rate they’d sold at during 1997 and 1998. In the month before the Nasdaq peaked, insiders were selling 23 times as many shares as they bought.

So, who ended up holding the bag? Average investors. Over the course of the year 2000, as the stock market began its meltdown, individual investors continued to pour $260 billion into US equity funds. This was up from the $150 billion invested in the market in 1998 and $176 billion invested in 1999. Everyday people were the most aggressive investors in the dot-com bubble at the very moment the bubble was at its height — and at the moment the smart money was getting out. By 2002, 100 million individual investors had lost $5 trillion in the stock market. A Vanguard study showed that by the end of 2002, 70 percent of 401(k)s had lost at least one-fifth of their value; 45 percent had lost more than one-fifth.

In recent years, there’s been a lot of talk about how the American public — especially the middle and working classes — have come to believe the economic structure of America is rigged against them, and everything is tilted in favor of the moneyed, the elite. I’d argue that this belief first took hold when the dot-com bubble burst, especially to investors who came to the stock market for the first time in those years. Baby Boomers invested in stocks; they bought and held. For a time, they did well, seeing their nest eggs go up by five, even six, figures. Then they watched it all evaporate.

Baby Boomers watched the insiders and the bankers, the lucky and the elite, walk away scot-free while they, the hardworking people who did what they were told, lost everything. This all happened to them again less than a decade later in the housing market. The bursting of the dot-com bubble was the opening act of our current economic era, and the repercussions from its aftermath are still with us today, economically, socially, and politically.

Even now when entrepreneurs talk about how their technology will change the world, in the back of their minds is the cautionary tale of the dot-com bubble’s implosion.

At the same time, a whole generation of workers who staked their careers on the dream of technology were unemployed. It was later estimated that between 2001 and early 2004, Silicon Valley alone lost 200,000 jobs. In the space of a decade, a group of people had gone from being young upstarts who “got it,” to masters of the universe who were transforming the world, to completely redundant. The hangover from this comeuppance haunts the tech industry today. Even now when young entrepreneurs talk glowingly about how their technology will change the world, in the back of any internet entrepreneur’s mind is the Icarus-like cautionary tale of the dot-com bubble’s implosion, as well as a fear that someday they too will be exposed for their hubris.

Many observers of the dot-com bubble have compared it to earlier bubbles like tulipomania in 17th-century Holland or the collapse of the South Sea Company in 18th-century London. But it’s the example of the railroads in Britain in the 1840s that’s the most analogous. Railways were cutting-edge in the 1840s. As with the dot-coms, there was a period when Britons rushed to invest in schemes surrounding this new technology. Eight hundred miles of new railways were floated for development in 1844; 2,820 miles of new track were proposed in 1845; 3,350 miles authorized in 1846. Because Parliament had to pass legislation approving each scheme, the railway bills passed by Parliament provide an amusing analogy to the IPOs of the dot-com period. Forty-eight railway acts were passed by Parliament in 1844, and 120 in 1845. By 1847, investment in the railways represented 6.7 percent of all national income.

The railroad bust came because, in historian Christian Wolmar’s words, the bubble was ultimately based on “little more than optimism feeding on itself.” It was pricked in part by the Bank of England raising interest rates, and its aftermath feels similar to the aftermath of the dot-com asco, albeit with a Victorian tinge. As Wolmar wrote in his book Fire and Steam: How the Railways Transformed Britain, “A contemporary chronicler reckoned “no other panic was ever so fatal to the middle class. . . . There was scarcely an important town in England what [sic] beheld some wretched suicide. It reached every hearth, it saddened every heart in the metropolis.”

What Wolmar’s account also points out is to what degree the bubble, and the railroads constructed from it, created the infrastructure that would enable the high Industrial Revolution in Britain. The mileage of rail schemes authorized in the bubble years came to represent 90 percent of the total route mileage on Britain’s rail system.

All of the money poured into tech companies in the first half decade of the Internet Era created an infrastructure and economic foundation that would allow the internet to mature.

But even after the railway investment mania went away, the railways never did … and the lesson of the dot-com bubble is similar. While the dot-coms went away, while AOL — for one brief shining moment, the embodiment of the internet in American life — went away, the internet itselfdidn’t go away. All of the money poured into tech companies in the first half decade of the Internet Era built out the infrastructure and economic foundation that would allow the internet to mature in a tangible, physical way. During the dot-com bubble, there was a less publicized bubble in telecommunications companies. Thisestimated $2 trillion bubble ended in a similar bloodbath with the bankruptcies of companies like WorldCom and Global Crossing.

Before the bubble burst, telecom companies raised $1.6 trillion on Wall Street and floated $600 billion in bonds to crisscross the country in digital infrastructure. These 80.2 million miles of fiber optic cable represented fully 76 percent of the total base digital wiring installed in the United States up to that point in history and would allow for the maturation of the internet. And because of a resulting glut of fiber in the years after the dot-com bubble burst, there was a severe overcapacity in bandwidth for internet usage that allowed the next wave of companies to deliver sophisticated new internet services on the cheap. By 2004, the cost of bandwidth had fallen by more than 90 percent, despite internet usage doubling every few years. As late as 2005, as much as 85 percent of broadband capacity in the United States was still going unused. That meant as soon as new “killer apps” were developed, there was plenty of cheap capacity allowing them to roll out to the masses. The tracks, as it were, had already been laid.

Many have made the case that the dot-com era was doomed to failure simply because there were too many companies chasing what at the time were too few users. When the bubble burst in 2000, there were only around 400 million people online worldwide. Ten years later, there would be more than 2 billion (best estimates peg the current number of internet users at 3.4 billion). In the year 2000, there were approximately 17 million websites. By 2010, there were an estimated 200 million (today, that number is over a billion). Far from being a fad, the habits we acquired during the bubble era ingrained themselves into the rhythms of everyday life. The dot-coms from that time, the training wheels for the internet, taught us to live online.

Excerpted from the new book How the Internet Happened: From Netscape to the iPhone by Brian McCullough. Copyright © 2018 by Brian McCullough. Reprinted by permission of Liveright Publishing Corporation, a division of W.W. Norton & Company. All rights reserved.

Watch Brian McCullough’s TED talk here:

Published By

Latest entries

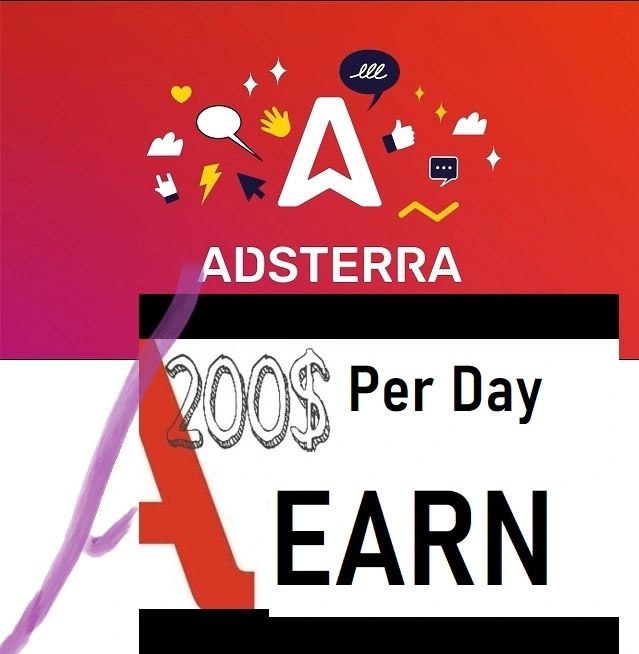

allPost2025.01.30Over 300 first responders are working scene of plane crash, officials say

allPost2025.01.30Over 300 first responders are working scene of plane crash, officials say allPost2025.01.30American Airlines CEO offers condolences on D.C. plane crash

allPost2025.01.30American Airlines CEO offers condolences on D.C. plane crash allPost2025.01.30Special Report: American Airlines regional jet crashes after collision with Black Hawk helicopter

allPost2025.01.30Special Report: American Airlines regional jet crashes after collision with Black Hawk helicopter allPost2025.01.30Law enforcement says American Airlines plane broke in two pieces

allPost2025.01.30Law enforcement says American Airlines plane broke in two pieces