Quantitative Finance (New York) in New York, NY for Capital Fund Management

Details

Try Adsterra Earnings, it’s 100% Authentic to make money more and more.

Posted: 16-Feb-22

Location: New York, New York

Preferred Education: Doctorate

Categories:

Computer Science: Computer Design and Engineering

Mathematics

Physics: Physics

Sector:

Private Sector

Work Function:

Research and Development

Additional Information:

Telecommuting is allowed.

Is CFM what you’re looking for?

We’re a global asset manager, founded in 1991 and a pioneer in the field of quantitative trading. We are innovative, collaborative and believe in diversity with around 30 nationalities, across our several offices around the world.

What can CFM offer you?

We create an environment for highly-talented and passionate PhDs, IT engineers and other recognized experts to explore new ideas and challenge assumptions. We are a Great Place to Work and welcome those who are intellectually curious and keen to see CFM’s thinking, research and analysis come to life in a way that benefits our clients.

Are you passionate about Research?

The success of CFM is borne from our scientific and collaborative approach to research; we value and invest significantly in R&D. If you’re a team-player, curious and want to contribute to pioneering research into financial markets, come and join our team!

Position:

The position involves applied research in financial time series in order to detect and exploit any robust statistical pattern. The aim is to build new strategies, to supplement those already devised and implemented by CFM. You will be working in a team of 55 researchers in close collaboration with software engineers.

The work will consist in developing statistical tools, exploiting recent theoretical models, carefully backtesting the robustness through data analysis and implementing them in practice.

The candidate should be both creative, in order to imagine new ways of detecting hidden statistical patterns, and rigorous.

Although a high interest in finance is crucial, no prior experience in the quantitative finance is required.

The position will be held in New York.

Ideal Candidate:

-

PhD in theoretical, experimental or computational science fields such as physics, mathematics, computer science or engineering

-

Two years of professional experience or post doctoral experience is preferred

-

Taste for analysis of complex data sets, modelling and practical implementations in simulation environments

-

Proficiency in scientific programming. As part of the interview process, candidates will be required to code in Python

-

Adaptable and rigorous, capable of working in a quickly evolving environment

-

Strong teamwork and communication skills.

More Story on Source:

*here*

Quantitative Finance (New York) in New York, NY for Capital Fund Management

Published By

Latest entries

allPost2025.01.31Pardoned Jan. 6 rioter sentenced to 10 years for fatal DWI crash

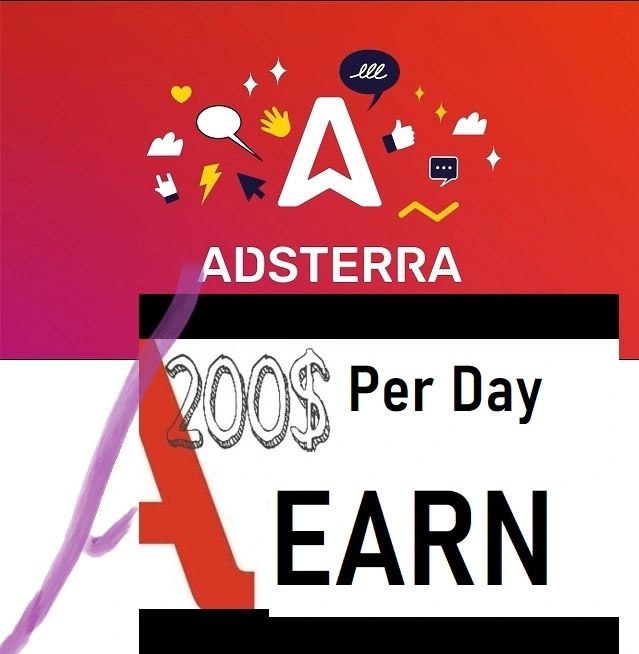

allPost2025.01.31Pardoned Jan. 6 rioter sentenced to 10 years for fatal DWI crash allPost2025.01.31After crash, questions about air traffic control staffing

allPost2025.01.31After crash, questions about air traffic control staffing allPost2025.01.3110-year-old grieves friends and coach on Potomac flight

allPost2025.01.3110-year-old grieves friends and coach on Potomac flight allPost2025.01.31‘It’s tragic’: Former figure skating Olympian reacts to skaters who died in crash

allPost2025.01.31‘It’s tragic’: Former figure skating Olympian reacts to skaters who died in crash