Content

The value of these education credits that you could then claim may be a greater value to you than the dependency exemption is to your parents. If you meet all of these criteria as a qualifying child or qualifying relative, you are a dependent. You can’t claim the personal exemption, even if the person who you are the dependent of doesn’t file with you listed as a dependent.

Find out what adjustments and deductions are available and whether you qualify. All dependents must be either US citizens, nationals, resident aliens, or residents of Canada or Mexico (and have a SSN, ITIN, or ATIN). Additionally, you cannot claim someone as a dependent if they are filing a joint return with a spouse. A dependent is someone who relies on you for financial support, including housing, food, clothing, and more.

For Caregivers

Caregivers can use the IRS Worksheet for Determining Support to break down this financial comparison. First, you will both get a notice from the IRS and will need to respond with the proper documentation. If you claimed yourself, and your parents claimed you, one of you has to make the correction to the tax return. After that return is processed, the other party may file their return next. In a nutshell, a child will be treated as being the qualifying relative of his or her noncustodial parent if all four of the following statements are true. Scholarships or grants received by the student do not count as the student providing their own support.

- CoveredCA.com is sponsored by Covered California and the Department of Health Care Services, which work together to support health insurance shoppers to get the coverage and care that’s right for them.

- In that case, you must complete Form 1040 and supplement it with Schedule 1 if filing taxes electronically or Form 1040A if filing manually.

- SmartAsset Advisors, LLC (“SmartAsset”), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S.

- As you start working and making money, you are supporting yourself through your life and education.

- When multiple people contribute to a parent’s living expenses, the issue of who can claim the dependent parent arises, as typically, no singular person gives at least 50% support.

If you are a tax dependent of someone else, you need to include their income information on your application. If you do not know it, you will need to contact that person to get their income information. SmartAsset Advisors, LLC (“SmartAsset”), a wholly owned https://turbo-tax.org/ subsidiary of Financial Insight Technology, is registered with the U.S. SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments.

Your rights

The IRS knows that some taxpayers provide their children and relatives with financial support. That’s why the government offers folks with https://turbo-tax.org/can-i-claim-my-parents-as-dependents/ dependents the opportunity to reduce their tax burden. Being able to claim someone as a dependent may significantly lower your tax bill.

- Any of these relationships, including biological parents, are considered as qualifying relatives for the purpose of claiming a child as a dependent.

- You can only claim him if your checks are covering over half of his living expenses.

- If your ex claimed your dependent on their return when you had the right to this year, this can lead to legal problems as the dependent benefits cannot be split.

- If you don’t meet the requirements of being a qualifying child for either parent, chances are, you can still be a qualifying relative.

- If you have more than four dependents, list their information on a separate page as instructed.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Family caregivers often carry a significant financial burden when caring for a parent. Claiming your parent as a dependent helps reduce your tax burden, but it’s essential to ensure you meet the qualifications that make a person eligible to claim a dependent.

“Can I claim myself as a dependent?”

However, you must determine if you are eligible to take the personal exemption. A tax dependent is a child, spouse, family member, and even an unrelated friend who needs your financial support and lives with you. Dependents can be claimed by a taxpayer as an exemption to reduce the amount of taxes that will have to be paid. The IRS calls this a dependency exemption, and each one will decrease the amount of income that you will owe taxes on. Special consideration must be given to multiple support agreements. This is an agreement signed by 2 or more taxpayers who provide financial support for the same dependent.

- We do not include the universe of companies or financial offers that may be available to you.

- Only those representatives with Advisor in their title or who otherwise disclose their status as an advisor of NMWMC are credentialed as NMWMC representatives to provide investment advisory services.

- A dependent is someone who relies on you for financial support, including housing, food, clothing, and more.

- Your parent, in-law, grandparent, or other relative does not have to live with you all year like a non-relative.

- In the case of Multiple Support Agreements, two or more people combined provide for more than half a person’s support.

You can be covered as a dependent up to age 26 on your parent’s Marketplace policy. If your parents don’t claim you as a tax dependent (and you file independently), then your eligibility for premium tax credits will be based on your income alone. As a result, many young adults will simply enroll in their own separate policy. With your income at roughly 220% FPL, you will qualify for a premium tax credit. Caregiving can be expensive, but there are ways to save on taxes.

Published By

Latest entries

allPost2025.01.31‘It’s tragic’: Former figure skating Olympian reacts to skaters who died in crash

allPost2025.01.31‘It’s tragic’: Former figure skating Olympian reacts to skaters who died in crash allPost2025.01.31Elite figure skaters among the lives lost in the midair collision

allPost2025.01.31Elite figure skaters among the lives lost in the midair collision allPost2025.01.31Nightly News Full Episode – Jan. 30

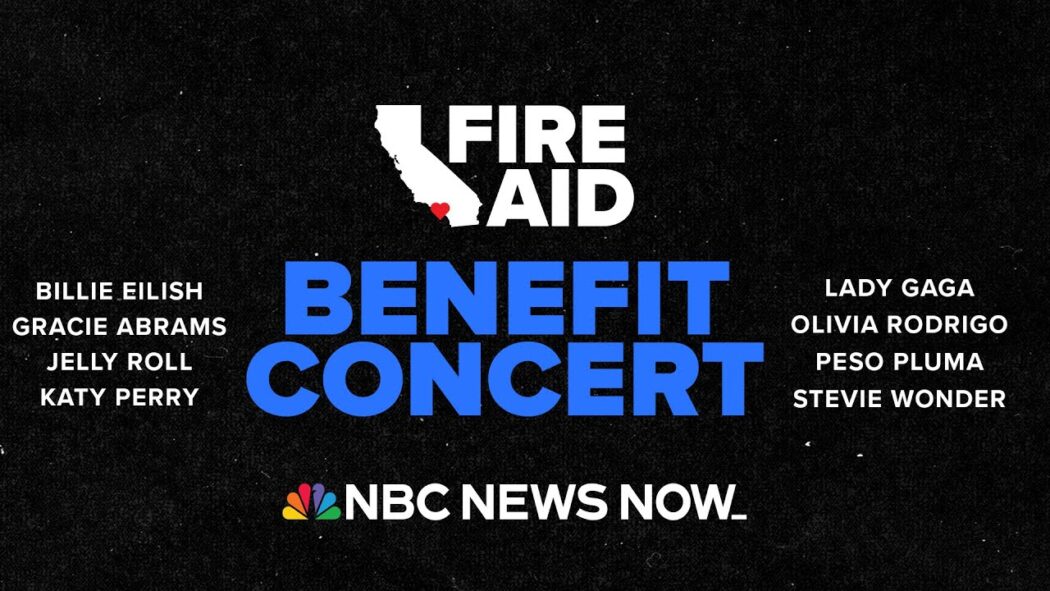

allPost2025.01.31Nightly News Full Episode – Jan. 30 allPost2025.01.31WATCH LIVE: FireAid – L.A. Wildfire Benefit Concert | NBC News NOW

allPost2025.01.31WATCH LIVE: FireAid – L.A. Wildfire Benefit Concert | NBC News NOW