Content

Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN. The IRS no longer requires you to keep the 1095-B form and you do not need it to file your taxes. You will not need to send the IRS proof of your health coverage.

Resident Aliens for Tax Purposes DO NEED a Form 1095-C from each employer that they worked for that also provided health insurance benefits. If you are student AND qualify as a Resident Alien for Tax Purposes AND you had the UC Student Health Insurance Plan in the past year, you will need a 1095-C from United Health Care. This ensures you keep all your tax documents up-to-date throughout the year. It will save you a lot of time when you file your taxes next year.

A separate form, the 1095-B, provides details about an employee’s actual insurance coverage, including who in the worker’s family was covered. This form is sent out by the insurance provider rather than the employer. Generally speaking, nonresidents will not need their 1095 A, B, or C when filing their tax return… In very limited circumstances , 1095-A can be used to claim a tax credit in your tax return.

Additional Resources

Health Insurance Marketplace consumers always have the option to personally fill in 1095-A forms. Although it is not as convenient as receiving a pre-filled form, the process is quite simple. These forms are readily available to download on IRS.gov.

- The best part is that you may be able to file your taxes for free.

- The start of a new year means it’s time to file your federal tax return.

- Depending on one’s source of health insurance, a taxpayer must submit Form 1095-A, Form 1095-B or Form 1095-C form to prove one’s access to health insurance.

- Think of this form as peace of mind through proof of insurance.

- Make sure that your employers have your current address as the paper form may be sent to you in the mail.

- Form 1095-A is issued to you by the Marketplace, not the IRS.

- If you are a Nonresident Alien and did not have any income in the last calendar year (January 1-December 31), you still need to file Form 8843.

Keep your 1095-C for your records with your other important tax documents. While you will not need to attach your 1095-C to your tax return or send it to the IRS, you may use information from your 1095-C to help complete your tax return. If you were full-time or were enrolled in health insurance through the University of Pittsburgh’s employer group health plan at any time during 2020, you may receive a 1095-C. You do not need to wait for either of these 1095 forms to file your tax return, but you should keep them for your records. Every international student, along with their dependents, will need to file Form 8843 separately. If you have received income in the last calendar year then you will need to file Form 8843 and most likely Form 1040-NR also.

Both cardholders will have equal access to and ownership of all funds added to the card account. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. See Online and Mobile Banking Agreement for details. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas.

How To Prepare Your Taxes And File Your Tax Return Possibly For Free

If the information on your Form 1095-A is wrong, you need to have it corrected before completing Form 8962. You can request an updated form by contacting the Health Insurance Marketplace. Again, you need Form 1095-A to complete each section of the form, as well as your Form 1040 showing your modified adjusted gross income. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate. Rebecca Lake is a journalist with 10+ years of experience reporting on personal finance.

The purpose of the form is to designate an accurate tax credit based on factors such as income, family size, and age. Tax credits help Americans pay for health insurance through the Health Insurance Marketplace. When someone receives a premium tax credit and does not file taxes, Covered California will not continue to provide financial assistance in paying for their coverage. Form 1095-C is not required to complete your federal tax returns.However, you should keep it with your W-2 and other tax return documentation. Questions on how to prepare your returns should be directed to a tax professional or the IRS.

Filing U S Taxes

You can choose whether to receive your W-2 and 1095c’s electronically or through regular mail. If you do not receive a Form 1095-B and you would like a Form 1095-B for your records, you should contact your eligibility worker at your county human services agency to determine why and request a reprint. Contact yourcounty human services agencycounty eligibility worker to verify or update your contact information for Medi-Cal. If you got any of the forms identified above, do not throw them away.

Form 1095-B serves as proof that an individual had qualifying coverage, referred to as minimum essential coverage, when filing their federal income tax statements. The deadline to file taxes is rapidly approaching.

In this guide, we will cover everything you need to know about 1095 forms and how to file a compliant tax return. If missing members also have Medicare coverage, the exclusion was due to a systems error. BlueCross will correct and reprint those forms.No action is required.You do not need to contact customer service to request a corrected form. Before Jan. 31, 2016, BlueCross mailed 1095-B Forms to OU BlueLincs HMO members. Form 1095-B is proof that you were enrolled in the type of medical insurance coverage required by the Affordable Care Act.

Can I File My Tax Return If I Have Not Received A Form 1095

All Americans are now required by law to purchase qualified health insurance, and if Americans do not adhere to the mandates set forth by the ACA, then he or she is subject to a penalty or fee. This amount will be deducted from one’s tax returns. The good news is that you may be eligible to deduct a portion of the interest paid on your federal tax return. So it’s important to keep a copy of this form close by when filing your taxes. It is important that you report your current address to that marketplace and the health plan that covered you so they can send the Form 1095-A to your current address. Or no health coverage at all, the tax penalty no longer applies.

- Check out my blog posts and feel free to ask me any questions.

- International students are required to file a tax return if they owe taxes or if they want to claim a refund or credits.

- Form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace.

- This form is used to verify on your tax return that you and your dependents have at least minimum qualifying health insurance coverage.

- Together, we’re delivering ever-better health care experiences to everyone in our diverse communities.

However, some companies are “self-insured,” meaning that they pay their workers’ medical bills themselves, rather than paying premiums to an insurance company. The server is temporarily unable to service your request due to maintenance downtime or capacity problems. 1040 Schedule A filers who itemize because of mortgage payments, child care expenses, charitable donations or medical expenses. The best plan for your needs will depend on your overall tax situation. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear.

Public Healthcare

This means that whether or not you received income, you must file Form 8843. The SSN is a nine-digit number issued to US citizens, permanent residents, and nonresident https://turbo-tax.org/ aliens who are eligible to work in the US. The SSN is used to report wages to the government, track Social Security benefits, and for other identification purposes.

If it is determined that you are a resident alien for tax purposes, this does not change your immigration status. You are still considered an international student on an F or J visa, a non-immigrant status, and not a permanent resident of the U.S. To learn more about your new benefits, your welcome packet, and what to do if you have an urgent health care issue please visit the New to Oregon Health Planweb page.

What Happens If My Tax Return Is Not Filed Correctly?

So watch your mailbox and/or your online accounts for more information. Most military tax forms are released by the end of January. If you are getting health insurance through the Marketplace and qualify for Premium Tax Credits , you must file Form 8962 with your tax return—whether you receive an Advance PTC or claim a PTC at year-end. You fill it out with the help of a Health Insurance Marketplace Statement (Form 1095 c turbotax 1095-A), which should be sent to you by your local health exchange. If you’re filling out a paper tax return and mailing your forms to the IRS, you include Form 8962 with your Form 1040. You then mail your forms to the IRS regional office that covers your state of residence. The IRS offers a helpful table that breaks down where to send your Form 1040 and any accompanying forms, such as Form 8962, on its website.

1095-B Form serves as proof of qualified health insurance coverage . This proof of coverage is required for your income tax filing. 1099-HC Form serves as proof of health insurance coverage for Massachusetts residents age 18 and older. You may get multiple forms, depending on the details of your job and health coverage during 2015, said Lindsey Buchholz, a program manager at the Tax Institute at H&R Block. The Form 1095-B is used as proof of Minimum Essential Coverage when filing your state and/or federal taxes.

Irs Resources

What’s more, our software will ensure you receive every tax relief you’re entitled to – maximizing your tax refund. Your student loan servicer will provide a copy – either physical or electronic – of your 1098-E to detail the interest paid in a tax year. Generally speaking, nonresidents will not need their 1095 A, B, or C when filing their tax return. IRS form 1095-B details the months of coverage that you, your spouse and/or any eligible dependents had for each month. Now that you are signed up for updates from Covered California, we will send you tips and reminders to help with your health coverage.

How To Get Your Child Tax Credit Payments And Register With The Irs

The Form 1095-C contains important information about the healthcare coverage offered or provided to you by your employer. Information from the form may be referenced when filing your tax return and/or to help determine your eligibility for a premium tax credit. Think of the form as your “proof of insurance” for the IRS.

Timing is based on an e-filed return with direct deposit to your Card Account. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority.

Published By

Latest entries

allPost2025.01.31‘It’s tragic’: Former figure skating Olympian reacts to skaters who died in crash

allPost2025.01.31‘It’s tragic’: Former figure skating Olympian reacts to skaters who died in crash allPost2025.01.31Elite figure skaters among the lives lost in the midair collision

allPost2025.01.31Elite figure skaters among the lives lost in the midair collision allPost2025.01.31Nightly News Full Episode – Jan. 30

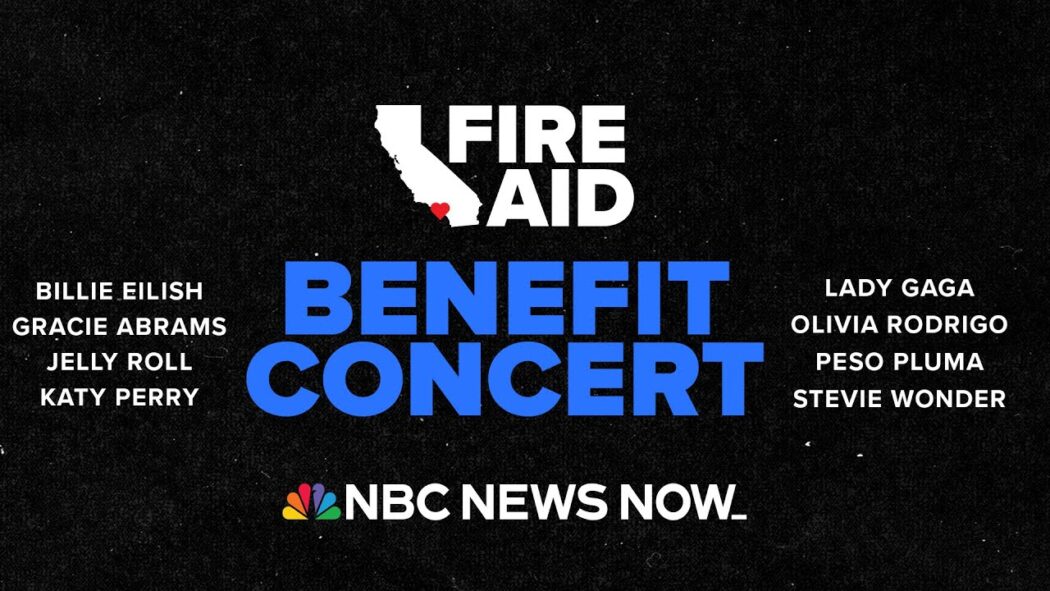

allPost2025.01.31Nightly News Full Episode – Jan. 30 allPost2025.01.31WATCH LIVE: FireAid – L.A. Wildfire Benefit Concert | NBC News NOW

allPost2025.01.31WATCH LIVE: FireAid – L.A. Wildfire Benefit Concert | NBC News NOW