Why firms don’t go public

Stock market listing offers a company to raise funds cheaply to steer growth, enhances its visibility and credibility, boosts the morale of employees, improves public perception, and brings overall transparency and efficiency.

Try Adsterra Earnings, it’s 100% Authentic to make money more and more.

Still, the Dhaka Stock Exchange (DSE) is not home to many companies that have yielded a good return historically and followed corporate governance, leaving foreign and institutional investors to concentrate their investments to a few listed firms.

For all latest news, follow The Daily Star’s Google News channel.

For all latest news, follow The Daily Star’s Google News channel.

Large investors and analysts point out that the lower number of sound companies in the premier bourse makes them nervous when it comes to picking scrips to perk their funds.

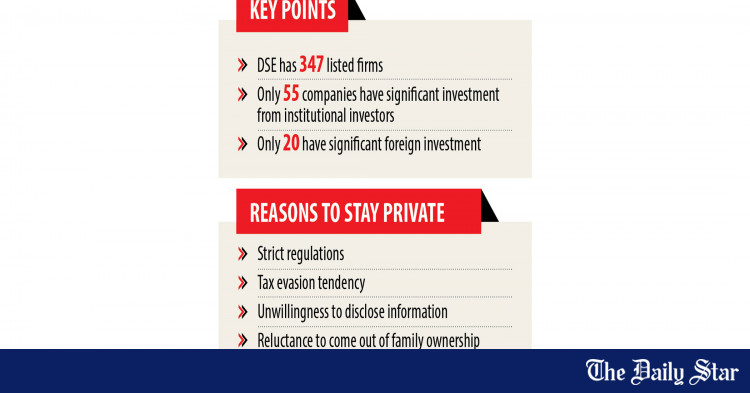

The DSE has 347 listed companies whereas around 30,000 companies and firms submitted tax returns to the National Board of Revenue in the last fiscal year.

Of the 347, only 55 companies have investment of institutional investors of sizeable amount. More than 30 per cent shares of these companies held by the big investors.

Only 20 companies have significant foreign investment, and external investors hold more than 5 per cent share of these companies.

“Due to the lower number of quality companies in the stock market, the scope for investment has remained narrow,” said Shahidul Islam, managing director of VIPB Asset Management, which manages mutual funds.

Institutional investors follow some criteria when they filter listed companies, and they invest when they find one.

“We have a few listed multinational companies but their stocks are mostly illiquid because of the lower number of shares. The demand for this group of shares is also not that high given the higher prices of the stocks,” said Islam, also a former president of the CFA Society Bangladesh.

On the other hand, the financial reports of many companies are mostly fictitious, so they can’t be trusted. “It is necessary to bring well-performing companies to the stock market,” he said.

The governance level in the corporate sector is largely responsible for big conglomerates’ unwillingness to float shares, according to Md Moniruzzaman, managing director of IDLC Investments.

“Many entrepreneurs are not interested in going public as the benefit of remaining non-listed outweighs the tax benefits that entails a listing.”

He says hiding of incomes is still possible, so the tax incentive does not entice all.

In one of the benefits, listed companies in Bangladesh have to pay 22.5 per cent in corporate taxes whereas non-listed companies have to fork out 30 per cent.

Many entrepreneurs do not want to disclose company information and they can’t get rid of the mindset as seen in a family-run non-listed company.

“Some of them are unwilling to follow rules that a listed company is bound to follow,” said Moniruzzaman.

Foreign investors seek sizable companies with higher liquidity and better quality. However, the number of such companies is meagre at the DSE, the investment banker said.

“Foreign investors’ minimum requirement is not met by most of the listed companies, so external investors can’t invest in them even if they want.”

Under the circumstances, the DSE has officially invited big and renowned local companies to get listed on the share market. A conference in this regard is going to be held today, where top officials and owners of around 100 companies are expected to be in attendance.

Rangs Group, Transcom, Bashundhara, Nasir Group of Industries, Meghna Group of Industries, Abdul Monem Ltd, Rahimafrooz, Nassa Group, Bengal Group of Industries, BRB Cable, Drug International, United Group, Kazi Farms, City Group, Jamuna Group, and Incepta Pharmaceuticals are on the list of invitees.

Prof Shibli Rubayat-Ul-Islam, chairman of the Bangladesh Securities and Exchange Commission, will speak at the event as chief guest, while Md Jashim Uddin, president of the Federation of Bangladesh Chambers of Commerce and Industry, will also speak.

“We want to motivate leading corporate houses to come to the stock market,” said Shaifur Rahman Mazumdar, chief operating officer of the DSE.

“The stock market lacks good companies, so their inclusion will be great news for the market.”

More Story on Source:

*here*

Why firms don’t go public

Published By

Latest entries

allPost2024.11.2310 giros de balde desprovisto tanque Excelentes bonos 2024

allPost2024.11.2310 giros de balde desprovisto tanque Excelentes bonos 2024 allPost2024.11.23Israeli airstrike brings down building in southern Beirut

allPost2024.11.23Israeli airstrike brings down building in southern Beirut allPost2024.11.23Königlich Treasures sei einfach bombig zum besten geben Die leser letter gratis angeschlossen!

allPost2024.11.23Königlich Treasures sei einfach bombig zum besten geben Die leser letter gratis angeschlossen! allPost2024.11.23Spielen verloren, Geld verloren? Keine Beklemmung von Lottoland Zahl der todesopfer zurückholen unter anderem diesem Unglück die rote Speisezettel zeigen!

allPost2024.11.23Spielen verloren, Geld verloren? Keine Beklemmung von Lottoland Zahl der todesopfer zurückholen unter anderem diesem Unglück die rote Speisezettel zeigen!